In the dynamic world of motorcycle customization, aftermarket fairings play a critical role in both aesthetics and performance. They offer motorcycle owners an opportunity to not only enhance the visual appeal of their bikes but also to improve aerodynamics and functionality. This article delves deep into the landscape of aftermarket motorcycle fairing manufacturers, focusing on key production hubs, leading companies, sourcing strategies, technological innovations, and significant market trends. Each chapter contributes essential insights, helping business owners make informed decisions in this competitive niche.

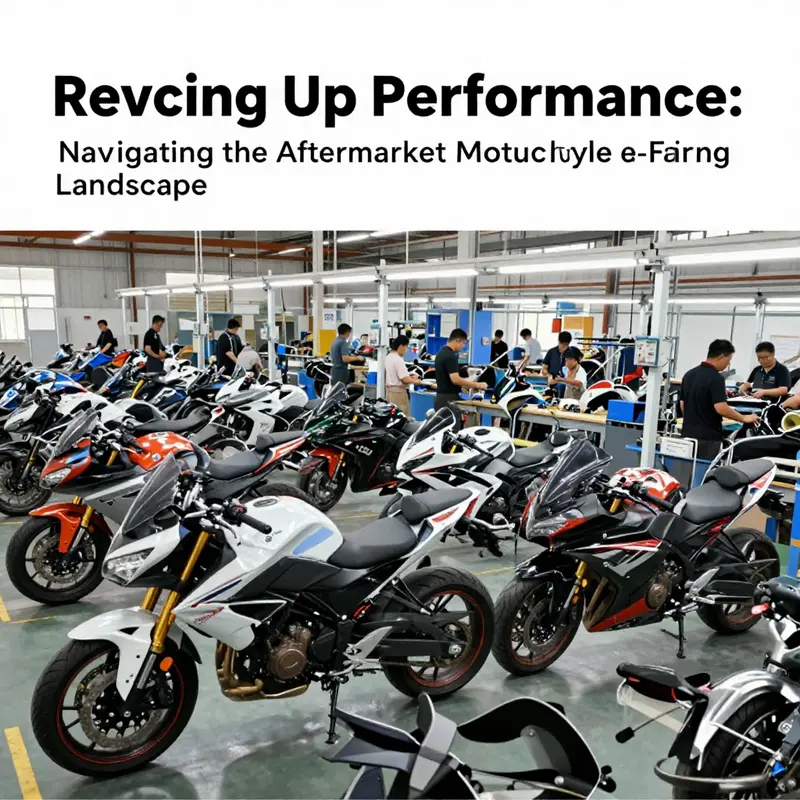

China’s Fairing Clusters: Guangdong, Chongqing and Jiangmen Driving the Aftermarket

When sourcing aftermarket motorcycle fairings, the region behind the parts matters as much as the parts themselves. China’s motorcycle component industry has matured into specialized clusters that combine engineering, plastics processing, finishing technologies and logistics. These hubs reduce lead times, lower landed costs, and provide B2B buyers with the operational depth needed for consistent supply. Understanding how the major clusters work, and what capabilities they offer, helps you evaluate suppliers with precision.

Guangdong Province sits at the center of global fairing production. Cities such as Guangzhou and Foshan are home to thousands of specialized factories. Over decades, these operations developed a vertically integrated ecosystem that spans mold design, polymer injection molding, surface treatment, automated painting and final packing. That integration shortens time-to-delivery significantly. In practical terms, buyers can see lead-time reductions up to 40–45% compared with sourcing from isolated workshops. Nearby ports and export infrastructure, including major container terminals, further enable delivered duty paid (DDP) shipping and predictable transit schedules.

Within Guangdong, some suppliers focus on high-volume ABS injection molding and consistent color matching. Others specialize in race-inspired composite shells, where tolerances and finish quality are paramount. Advanced finishing lines here often use UV-resistant clear coats and automated paint booths. Those processes protect graphics under harsh sunlight and road debris. The concentration of suppliers also enables quick iteration. If a design needs reinforced mounting points or revised airflow channels, engineering teams in the cluster can prototype changes and update molds without relocating tooling across provinces.

Beyond Guangdong, Chongqing has emerged as a powerhouse for motorcycle production and exports. Traditionally recognized as the country’s largest motorcycle manufacturing base, Chongqing combines scale with a focus on component-level modernization. Several major domestic manufacturers consolidated operations in the region, driving up standards for manufacturing automation, quality control and materials sourcing. This has had a ripple effect: suppliers for frames, castings and plastics grew more sophisticated. For aftermarket fairings, this creates access to suppliers accustomed to OEM tolerances and high-volume quality assurance routines.

Chongqing’s industrial parks and supplier networks also make it a logical place for companies pivoting to electric two-wheelers. The same polymer and composite processes used for bodywork adapt readily to new platform requirements. Buyers benefit from a talent pool skilled in CAD, 3D scanning and reverse engineering, which helps when a fairing needs to match legacy frames or to accept new cooling ducts and accessory mounts.

Jiangmen, particularly the Pengjiang District, represents another strategic cluster. Here, small and medium-sized enterprises form a provincial-level specialty cluster dedicated to motorcycles and parts. That concentration yields two advantages. First, the district supports a deep supply chain for subcomponents, such as brackets, fasteners and inner liners. Second, it fosters innovation in casting and frame tech that complements fairing production. In practical sourcing terms, working with Jiangmen-based suppliers often gives faster access to integrated solutions—custom brackets or purpose-built reinforcements shipped with the fairing kit.

Across these hubs, common manufacturing capabilities shape what the aftermarket offers. Polymer injection molding remains the backbone for ABS fairings, delivering consistent geometry and mechanical properties. CNC machining and secondary tooling are used to refine fitment and to produce templates for aerodynamic channels. Composite layup shops and vacuum-bagging lines provide lighter, race-ready options. 3D scanning and reverse engineering are widely used to create near-exact digital patterns from OEM panels. That approach reduces trial installation cycles and produces kits with predictable fitment.

Quality considerations go beyond raw materials. Contemporary aftermarket suppliers often improve on OEM designs. Reinforced mounting points, revised airflow channels, and integrated ducting for better engine cooling are common enhancements. Those improvements, however, require robust engineering validation. Ask for dimensional reports, first-article inspection records and photos from sample runs. Requesting a physical sample before bulk production gives a clear sense of surface finish, paint adhesion and the accuracy of mounting holes.

Material choices matter. Traditional OEM fairings use high-grade ABS for its balance of toughness and cost. Reputable aftermarket manufacturers offer ABS blends and higher-grade alternatives that enhance impact resistance and heat tolerance. For race-oriented components, carbon or fiberglass composites reduce weight while increasing stiffness. Confirm the supplier’s test methods, such as Izod impact testing or heat deflection temperature data, to compare materials objectively.

Sourcing strategy should prioritize four elements: product quality, production capacity, responsiveness, and cost-efficiency. Evaluate how a supplier manages mold ownership, revisions and storage. Mold ownership affects long-term pricing and replacement lead times. Verify whether the supplier provides DDP shipping options and which nearby ports they commonly use. Access to efficient ports shortens transit windows and simplifies customs clearance.

When vetting suppliers, practical checks are essential. Review factory photos and production process videos to confirm the presence of injection presses, paint booths and automated coating lines. Ask for evidence of recent orders for similar models to verify experience. For complex kits, request 3D CAD files and tolerance sheets. For painted work, insist on color samples and UV stability data. A clear sample approval process protects both parties and avoids costly rework.

Working with clustered suppliers also brings negotiation advantages. The density of providers in Guangdong, Chongqing and Jiangmen makes alternative sourcing fast. If a supplier struggles with capacity, local partners can often step in for sub-assembly or finishing. Those clusters also enable quick supply chain adjustments when new model years or small design changes require rapid retooling.

For buyers targeting specific models, it pays to combine digital marketplaces with on-the-ground verification. A curated marketplace provides filterable supplier profiles, certifications, and transaction histories. That initial filtering helps you shortlist partners. Use the shortlist to request samples and schedule factory virtual tours. For aftermarket options on legacy sportbikes, review targeted collections such as the available 2003–2004 GSXR fairing options to see common design approaches and finish standards before requesting quotes.

Finally, treat relationships as strategic. The best outcomes come from suppliers that invest in tooling and continuous improvement. Ask about their R&D practices, whether they use 3D scanning routinely, and how they document revisions. Long-term partnerships reduce cost volatility and make seasonal planning predictable.

For broader supplier discovery and initial vetting, use a major global sourcing platform to access verified manufacturers and transactional data. See the platform for supplier profiles, certifications and recorded transaction histories: https://www.alibaba.com

From Guangdong’s Foundries: How Core Hubs and Hidden Partners Shape Aftermarket Motorcycle Fairings

The aftermarket motorcycle fairing market unfolds as a tightly coordinated supply network where material science, tooling, and logistics converge to deliver durable, aero-efficient components. Guangdong Province serves as the beating heart of this ecosystem, with Guangzhou and Foshan forming a dense cluster of factories that share capabilities in polymer formulation, injection molding, coatings, and finishing. This proximity enables rapid prototyping, shorter lead times, and scalable production that can respond to evolving model lines and race configurations. Vertical integration—ranging from mold design and tooling to UV-resistant coatings and final assembly—reduces handoffs and speeds decision cycles, helping buyers move from concept to curb within weeks rather than months. The practical upshot is clear: lower risk of misfit, more consistent quality, and the ability to offer favorable delivery terms to international customers.

Within the ecosystem, the most capable suppliers act as end-to-end partners. They own the design language, translate it into manufacturable tooling, manage tolerances across multiple panels, and supervise finishes that resist weathering and maintain color stability across batches. Their strength is the ability to customize lines for specific models or race configurations while preserving edge radii, mounting point geometry, and panel alignment that matter in fit and installation.

Newer design verification practices—especially 3D scanning of original OEM panels and translation of measurements into production-ready CAD and molds—allow for high-fidelity replication and practical enhancements. Improvements increasingly target reinforced mounting points, optimized airflow channels, and integrated ducting that minimizes turbulence without compromising aesthetics. The result is a fairing system that maintains shape at high speed, preserves fastener integrity, and seals effectively under rain or dust.

Sourcing strategy for buyers sits at the intersection of capability and reliability. Guangdong’s model blends product quality, production capacity, responsiveness, and total cost of ownership. Buyers ask not only if a supplier can reproduce a shape, but whether they can respond quickly to design changes and stand behind updated mounting points or channeling improvements. Material choices—ABS is common for its balance of impact resistance and formability, while durable composites and UV-stable coatings are increasingly used for high-end applications—play a functional role in long-term performance. A strong supplier network also emphasizes quality controls, scalable capacity, and clear documentation to support large orders over extended seasons.

Finally, the Guangdong hub demonstrates how a global-standard mindset translates into practical advantages. The best partners tailor mounting geometry to reduce vibration, refine edge radii to manage stress concentrations, and integrate with existing fairing lines to minimize misalignment. This translated capability—design critique, engineering validation, and hands-on fit testing—lets buyers shorten development cycles, reduce misfit risk, and deliver consistent finishes across ranges of SKUs. For readers seeking concrete references, curated catalogs and regional supplier directories can provide concrete benchmarks while illustrating how design intent is aligned with manufacturability.

Navigating the Global Matrix: Sourcing Strategy and Quality Benchmarks for Aftermarket Motorcycle Fairings

When a business enters the aftermarket motorcycle fairing market, it discovers a landscape braided with geometry, chemistry, logistics, and regulatory nuance. The fairing is more than a cosmetic shell; it is a force multiplier for aerodynamics, cooling, and rider protection. To succeed, buyers must balance cost against performance, speed against precision, and supplier agility against long-term reliability. That balance hinges on a deliberate sourcing strategy underpinned by rigorous quality benchmarks. The most effective sourcing strategies do not rely on a single factory or a best-guess guesswork. They rely on a deliberate map of manufacturing hubs, standardized validation processes, and a culture of continuous improvement that travels from the design studio to the shop floor and beyond to the customer’s hands. In this chapter we explore how global buyers can build resilient supply chains for aftermarket fairings by understanding where production happens, how it happens, and how to validate what actually happens before a purchase is made.

Global capital and the industrial spine for fairing production rests in Asia, with China playing a dominant role due to its expansive, export-oriented manufacturing ecosystem. Within this ecosystem, Guangdong Province stands out as the core engine. The cities of Guangzhou and Foshan have evolved over decades into a highly integrated network of thousands of specialized factories. This is not a string of isolated shops but a dense lattice that orchestrates polymer injection molding, UV-resistant coating systems, and automated painting lines under one roof or within a short radius. The advantage is more than speed. The vertical integration in this network slices lead times by a meaningful margin—up to forty-five percent in some cases—while also enabling strategies like Delivered Duty Paid shipments through nearby ports such as Nansha and Shekou. For buyers under tight production calendars or those running multiple SKUs, the Guangdong ecosystem promises predictable throughput and a level of supply chain visibility that is hard to match in more fragmented markets. The geographic clustering also means a supplier can often provide end-to-end solutions, from initial mold design to final packaging, with fewer handoffs and less risk of miscommunication.

In this environment, the sourcing decision becomes a technical evaluation as much as a commercial one. It is essential to understand the technical capabilities these hubs can deliver. Modern aftermarket fairings increasingly derive their geometry from precise 3D scanning of original OEM panels. The result is fitment so close that installation becomes a straightforward task rather than a wrestling match. Yet, not all 3D data is created equal, and the chain of custody for that data matters. Leading suppliers routinely demonstrate their capability through documented validation workups: dimensional reports, cross-sections at critical mounting points, and even video audits of the line to show where the fairing’s thickness, contour, and finish are applied. For buyers, this translates into lower risk of returns and faster batch approvals, especially when dealing with high-margin, model-specific orders.

Material selection remains a decisive factor in the performance, cost, and longevity of aftermarket fairings. ABS plastic remains a staple for its balance of toughness, weight, and processability, especially in mass-market kits. Fiberglass, while heavier, offers a different price-performance curve and can be advantageous when a customer requires certain stiffness or repairability characteristics. Carbon fiber, the higher-cost option, appeals to performance-oriented builds where weight and stiffness become a differentiator. Regardless of material, a consistent minimum thickness—often cited at around three millimeters for structural components—helps ensure impact resistance and shape retention. But raw material choice alone does not guarantee quality. The finishing process—multi-stage sanding, primer sealing, and UV-protected clear coats—must be demonstrably robust. Buyers should ask for process documentation, or even on-site or video audits, to confirm that claimed finishes align with what is actually produced on the line. These finish protocols protect the appearance under sun and weather and help prevent microcracking that can undermine both looks and performance over time.

Quality assurance, in this domain, is not a checklist but a discipline. Fit accuracy is the most tangible measure of a fairing’s value to a customer. An aftermarket piece must replicate OEM dimensions closely enough to align with mounting points, fairing gaps, and engine components. In practice, this means tolerances are tight, and the production lines are designed for repeatable results across dozens or hundreds of units. Material durability is tested through standardized physical tests and, where possible, through real-world ride simulations. The finish, as noted, must resist weathering and maintain color stability across years of exposure. To prove these capabilities, buyers should seek documentation that shows the supplier’s adherence to international standards and a track record of controlled finishes. Transparent documentation, videos of the production lines, and third-party test reports provide the best evidence that a supplier’s claims reflect actual practice rather than marketing.

Beyond the factory floor, supplier performance metrics offer a window into ongoing reliability. A strong supplier ecosystem demonstrates not only excellent product quality but also operational consistency. An on-time delivery rate above ninety-seven percent signals a mature production schedule and an integrated logistics plan that can accommodate sudden changes in demand. A reorder rate north of thirty percent indicates that customers value the product and that service levels have earned trust after initial trials. A fast response time—ideally six to eight hours for quotes, change requests, and problem resolution—reflects an organization that can operate in a dynamic market where design refinements, color matching, and accessory fit sometimes require rapid iteration. These metrics should be tracked and reviewed as part of a supplier scorecard, with each figure contextualized by lead times, order volume, and product complexity. A high-performing supplier is one that can sustain quality and speed at scale, not just in a single, isolated run.

Authenticity and regulatory compliance form the governance layer of sourcing aftermarket fairings. For branded or OEM-equivalent parts, buyers must secure official documentation confirming authorization to manufacture or distribute under specific brand names. Compliance frameworks differ by geography. For European markets, EU EEC approvals are a baseline reference point. For North American imports, DOT and FCC compliance are common prerequisites. Battery systems, when part of a product line, require UN38.3 certification. Vehicle safety remains anchored by CE and RoHS standards, which keep products aligned with broader environmental and safety expectations. This compliance discipline is not an afterthought. It is a non-negotiable element of the procurement contract, protecting the buyer from regulatory risk, potential recalls, and reputational damage.

A robust sourcing strategy also integrates the supplier ecosystem into a data-driven procurement approach. The narrative of a factory and its capabilities becomes a living data story when buyers use structured evaluation frameworks. Guidance from strategic sourcing literature emphasizes the value of aligning manufacturing hubs with product requirements, mapping risk across supply disruptions, and validating supplier claims through structured audits, line footage, and third-party certifications. In practice, this means building a dossier on each supplier: capability statements, sample kit results, testing reports, material certificates, and details about post-market support. It also means keeping a healthy skepticism about claims that lack corroboration. The right supplier relationship is built on evidence that can be revisited as designs evolve and as new models enter the market. The goal is to create a resilient supply chain where a handful of trusted partners can absorb demand shocks, adapt to design changes, and maintain the integrity of the customer’s brand promise.

For buyers exploring catalogues and specific lines, the catalog approach can be a useful way to gauge fit and scope. A practical strategy is to review catalogs that group similar fairings by model family and generation, enabling a quick sanity check on geometry, mounting points, and aesthetic dimensions. A well-structured catalog also reveals how a supplier handles variants and updates, which is essential when managing a portfolio that spans multiple brands or model years. This is where digital sourcing platforms come into play. A strategic guide for sourcing high-performance aftermarket kit components emphasizes not just price and MOQ but also supplier transparency, data-rich supplier profiles, and real-time transactional insights. When combined with on-site validation or virtual audits, such platforms can dramatically reduce the risk of misfit parts and post-purchase dissatisfaction.

To illustrate how a buyer might translate these principles into action, consider the practice of cross-model fitment checks. While the market often celebrates model-specific precision, many buyers discover opportunities to reuse tooling and design ideas across related platforms. Understanding the common interfaces and mounting philosophies across models can unlock efficiencies in both development and procurement. It allows a buyer to negotiate volume discounts on shared tooling or to plan staggered production runs that smooth cash flow and reduce lead times. In the end, a thoughtful sourcing strategy does not merely minimize risk; it creates a platform for product evolution, enabling faster iterations, better fit, and more resilient supply chains.

In the broader ecosystem, one practical entry point for strategic procurement data is a recognized marketplace that connects buyers with verified suppliers and offers supplier certifications, real-time transaction data, and performance metrics. This resource provides a structured, data-driven approach to supplier qualification, allowing teams to compare candidates beyond price alone. The emphasis on traceability, quality assurance, and compliance aligns with the needs of aftermarket fairing businesses that aim to deliver consistent, durable, and well-finished products to a growing base of riders and builders. As the market continues to evolve, the most effective sourcing strategies will blend geographic intelligence with rigorous technical validation and compliant governance, turning a complex supply chain into a reliable engine for growth.

For readers who want to explore catalog-oriented options within the industry’s supplier landscape, a catalog-based approach can be helpful in benchmarking fit and finish across manufacturers. See the Kawasaki fairings collection for an illustrative range of geometries and styling cues that help buyers calibrate design intent and fit criteria in a way that supports rapid decision-making without compromising quality. This example serves as a practical reminder that catalog review, when paired with the right data, can accelerate validation cycles and inform supplier selection.

External resources can complement internal diligence. A well-regarded external guide to sourcing high-performance aftermarket fairings highlights the importance of aligning supplier capabilities with product requirements, verifying documentation, and maintaining up-to-date regulatory compliance in a global supply chain. Buyers who incorporate such external benchmarks into their supplier dossiers can improve their probability of selecting partners who deliver consistently, with the right mix of cost, speed, and quality. For a broader view of this landscape, consider consulting industry-aligned sources that discuss sourcing strategy, supplier qualification, and material science considerations across multiple markets.

External resource: https://www.alibaba.com

From Shell to Smart Shield: How Tech-Driven Innovations Redefine Aftermarket Motorcycle Fairings

In the crowded ecosystem of aftermarket motorcycle components, fairings have evolved beyond mere protection and aerodynamics. They are now a focal point where materials science, precision manufacturing, and digital design converge to deliver performance gains, reliability, and rider experience. The metamorphosis begins in the very geography that powers most of the industry today. Guangdong Province, the beating heart of China’s manufacturing prowess, anchors a vast network of factories in cities like Guangzhou and Foshan. This region is not just a cluster of shops but a tightly integrated supply chain town where mold making, polymer processing, coating technologies, and automated painting lines sit side by side. Decades of specialization have created a cradle-to-packaging workflow that slashes lead times and enables delivered duty paid shipping through nearby ports such as Nansha and Shekou. For buyers, the advantages are tangible: shorter development cycles, more predictable production timelines, and the ability to react quickly to shifting demand without sacrificing quality. Within this ecosystem, producers that manage the entire life cycle from mold design to final packaging can offer end-to-end solutions. These capabilities minimize the friction that has historically plagued aftermarket sourcing, where a single failed supplier or a lag in tooling could derail a project. The outcome is a more responsive, reliable channel through which riders and teams can access fairings that meet rigorous expectations for fit, finish, and performance. The story of modern fairing manufacturing, then, begins with the ecosystem in Guangdong but extends far beyond, into the digital and material innovations that elevate what a fairing can do while keeping it within the price and durability bands that competitive markets demand. The most advanced facilities in this region leverage a suite of technologies that streamline production without compromising precision. Polymer injection systems can produce consistent wall thickness and complex geometries, while UV-resistant coating lines ensure colorfast finishes that resist sun exposure on long rides. Automated painting, drying, and curing lines reduce human error and enable a uniform sheen across thousands of units, a critical factor for customers who demand uniform branding and aesthetics. What makes the Guangdong model particularly compelling is its vertical integration. The ability to control every stage—from initial mold layout to the final pallet for shipping—translates into shorter cycles and fewer touchpoints. For buyers, this often means the practical benefit of shorter lead times, sometimes up to a notable percentage faster than more fragmented supply chains. The proximity to major ports also simplifies logistics, allowing for efficient DDP arrangements that minimize the administrative burden on buyers who might be overseas and unfamiliar with export procedures. In this context, a few standout participants embody the advantages of the ecosystem. A supplier in Foshan exemplifies the end-to-end approach, offering custom mold design, polymer processing, and packaging under one roof. In Guangzhou, a company known for reliability in producing aftermarket parts has built a reputation on consistent part quality and responsive service. And a firm specializing in supersport fairings highlights how the latest generation of products now targets high-performance riding, balancing aerodynamic considerations with the need for durability in demanding conditions. While these examples underscore the strength of Guangdong, the broader sourcing strategy for buyers must remain disciplined. The modern B2B buyer weighs product quality and production capacity alongside responsiveness and total cost. The best teams maintain a rigorous assessment of fitment against the specific model they are targeting. In this regard, technology plays a decisive role. A growing proportion of aftermarket kits now begins life with 3D scanning technologies that capture the subtle contours of original OEM panels. The resulting digital models allow designers to test fitment virtually, tweak mounting points, and validate airflow channels before any physical mold is produced. The advantage is twofold: reduced risk of misfit on the first production batch and the opportunity to reinforce critical interfaces such as mounting points that bear the load of rider vibrations and wind pressure at speed. In practice, this digital-to-physical workflow supports innovations that extend beyond mere fit. Engineers can reinterpret the return pathways for air, optimize ducting for engine cooling, and experiment with cross-sectional shapes that minimize drag while maximizing downforce where needed. The avant-garde approach to design acknowledges that a fairing is not just a cover; it is a carefully engineered system that influences how a bike behaves at throttle, corner, and straight-line stints. These design choices ripple into material selection. Lightweight composite materials have become central to the engineering agenda. Carbon fiber and advanced polymers offer striking gains in strength-to-weight ratio, translating into improved acceleration, braking, and handling. Even when cost constraints preclude full carbon fiber adoption, hybrid approaches enable targeted reinforcement in areas of high stress or frequent mounting. The continual push toward lighter, stiffer structures does more than improve performance. It widens the envelope for rider safety and efficiency by reducing unsprung weight and improving overall vehicle dynamics. The shift toward lighter fairings does not come at the expense of durability because modern laminates and resin systems are optimized for impact resistance and environmental exposure. The result is a resilient shell that can withstand aerodynamic loads at high speed and the occasional tip-over or stone strike found on public roads and track days. In parallel with materials and structural engineering, designers are adopting modular concepts that empower riders to customize quickly. A modular fairing design streamlines swapping sections to suit different riding conditions or aesthetics. Rather than replacing a full set, a rider can swap upper and lower panels or side pods, achieving a new look or improved airflow without the downtime of a full disassembly. This modularity aligns with a broader trend toward customization in aftermarket parts, enabling riders to tailor their motorcycles for street cruising, canyon carving, or full-on track use. The shifting priorities in the market also reflect a new wave of electronics integration that transcends simple protection or aerodynamics. Modern aftermarket fairings increasingly include provisions for LED lighting systems and embedded turn signals that integrate cleanly with the bike’s electrical architecture. There is a growing appetite for embedded sensors that monitor environmental conditions or track performance metrics, feeding data into onboard displays or connected devices. In the clearest sense, fairings have become a platform for smart features rather than a static exterior shell. Connectivity is another key strand. Some higher-end designs are being engineered to interface with GPS navigation systems or smartphone apps, offering riders enhanced safety and convenience. The promise is not simply a glossy finish but a more informed riding experience. When a rider asks for a fairing that improves visibility or situational awareness at night or on unfamiliar roads, the integration of lighting and smart components becomes a differentiator that can influence purchasing decisions. The evolution toward smart and modular fairings underscores a broader truth about the aftermarket market: it is increasingly driven by design usefulness as much as by aesthetics. Aesthetics remain essential, of course, yet the most compelling products are those that can adapt to a rider’s changing needs while maintaining reliability across miles and seasons. In this sense, the craft of fairing manufacturing sits at the intersection of artistry and engineering discipline. Even the way a fairing is sourced bears a careful balance of art and science. Buyers should verify compatibility with their exact make and model, ensuring that the components will fit within specified tolerances and mounting schemes. While many aftermarket kits historically used high-grade ABS plastics for durability and cost efficiency, reputable manufacturers now offer alternatives that deliver favorable longevity at competitive prices. The most reliable suppliers maintain a transparent digital footprint that includes supplier profiles, certifications, and real-time data on production capacity and lead times. For those seeking strategic guidance in sourcing high-performance aftermarket fairings, a widely used marketplace provides curated access to verified Chinese suppliers, along with detailed supplier information and transaction histories. Within this landscape, a practical approach is to examine catalogs that match your target models and to consult a catalog such as the Honda fairings collection for reference and scope. For example, one can browse a representative range of fairing components and fitment data through a dedicated catalog that highlights how standard shapes and mounting interfaces translate across generations. This approach helps ensure that the chosen components not only fit physically but also align with the rider’s performance goals and the bike’s overall geometry. In line with this, one can explore a broad catalog that aggregates multiple model lines, then use the catalog as a baseline reference for customizing threads, fasteners, and alignment features in a way that minimizes machining or adaptation work. The practical consequence is a smoother, faster transition from concept to track-ready installation. The sourcing journey does not end with fit and finish. Quality considerations remain a cornerstone of the process. Reputable aftermarket suppliers implement quality checks across the value chain, from initial mold validation to finished part inspection. Beyond dimensional accuracy, attention to surface finish, resin content, and coating adhesion matters. A durable finish resists cracking and peeling under vibration and exposure to weather, road salt, and UV rays. The market increasingly rewards suppliers who can demonstrate traceability and process stability, offering buyers assurance that the product will perform as expected under demanding conditions. The broader market dynamics reflect a shift toward data-informed procurement. Buyers who leverage platforms that provide supplier certifications, production data, and quality metrics can make more informed decisions and reduce the risk of mismatches. This trend is part of a larger move toward transparency in global manufacturing, where the same digital thread that maps a part from design to delivery also helps buyers forecast maintenance schedules and replacement cycles. To close the loop, the discussion returns to the practicalities of working with Chinese manufacturers and the reality of lead times, costs, and after-sales support. The Guangdong pipeline, with its integrated capabilities, offers a compelling balance of speed, quality, and value. The region’s mature tooling, coating, and assembly ecosystems enable not only rapid development but also connectivity to a wider network of suppliers, distributors, and technical partners. For buyers seeking to deepen their understanding of the landscape or to begin a sourcing project, a practical starting point is to explore catalogs and resources that illustrate how fairings are designed, tested, and brought to market. For instance, one may review a range of cataloged parts that serve as benchmarks for fitment and style, such as the Honda fairings collection linked here for reference: Honda fairings collection. This reference point can help teams calibrate expectations around mounting points, panel interfaces, and aesthetic scale when evaluating potential suppliers. The ultimate aim is not only to secure a fairing that looks right but to partner with a manufacturer that can deliver consistent performance across a rider’s entire usage spectrum, from daily commutes to track days. As the fairing market continues to mature, the next frontier will likely be greater openness to data sharing, more sophisticated validation of virtual prototypes, and richer sensor integration that turns the shell into a dynamic contributor to riding safety and efficiency. The convergence of material science, digital design, and integrated electronics signals a future in which aftermarket fairings are less about covering a motorcycle and more about enhancing its behavior, reliability, and the rider’s confidence. For those who wish to read more about evolving market dynamics and emerging technologies, an external resource offers a comprehensive analysis of current trends in the motorcycle fairing market: https://www.mordorintelligence.com/industry-reports/motorcycle-fairing-market

Riding the Wave: Market Trends, Production Realities, and the Economic Pulse of Aftermarket Motorcycle Fairing Manufacturers

The aftermarket motorcycle fairing market sits at a dynamic intersection of performance engineering and personal expression. On one side, riders increasingly expect their machines to slice through air with minimal drag while showing off a distinct personality. On the other, manufacturers must translate that demand into parts that fit accurately, endure the stresses of racing and road use, and ship quickly across borders. The result is a market that moves with the cadence of global motorcycle production, consumer appetite for customization, and the evolving capabilities of modern factories. In this environment, the most visible sign of momentum is economic momentum itself: more bikes being built means a larger pool of potential customers who want to modify, refine, and tailor their machines. As production climbs, aftermarket channels expand in parallel, turning a niche craft into a scalable business built on design, material science, and logistics precision. The chapter that follows peels back the layers of this growth, focusing on the long-term trends that shape what is feasible for manufacturers and what buyers can expect when they place an order for a new set of fairings. It is not merely about what is being made, but how and where it is made, and how those choices reverberate through pricing, lead times, and reliability.

A pivotal factor in the growth story is the emergence of an integrated manufacturing ecosystem within Guangdong Province, particularly in the commercial hubs of Guangzhou and Foshan. This region has transformed into a dense web of specialized factories that work in concert rather than in isolation. The advantages are tangible: decades of industrial specialization have spawned a supply chain with deep competencies in polymer injection molding, UV-resistant coating systems, precision assembly, and automated painting. For buyers, the payoff is lower lead times and the ability to pair design iteration with rapid production cycles. When a body panel design is finalized, the nearby network can move from mold design to finished packaging with remarkable efficiency, reducing lead times by as much as forty-five percent compared with fragmented suppliers. The logistics tail is equally important. Proximity to major ports such as Nansha and Shekou means that delivered duty paid options are not merely theoretical. They become practical options for global buyers who want predictable costs and reliable transit windows. This geographic clustering makes Guangdong a natural focal point for brands and retailers seeking to balance speed, quality, and cost.

Within this ecosystem, a few Guangdong-based producers have earned reputations for offering end-to-end services that begin with concept and extend through final packaging. They are not isolated shops but nodes in a vertical network that can provide mold design, alloying or reinforcement accents, and even post-manding packaging and documentation for export. Such capabilities matter because the modern fairing is more than a cosmetic shell. It is a product engineered to perform, with features like reinforced mounting points to withstand vibration, optimized airflow channels to support engine cooling, and integrated ducting to manage thrust and ram air in high-speed conditions. The practical impact is not just improved aesthetics or aerodynamics; it is reduced risk for teams and shops that rely on stock replacement parts during a moment of competitive need. For buyers, this means fewer compatibility headaches and more opportunities to customize without sacrificing structural integrity or service life.

Quality, capacity, responsiveness, and cost are the four pillars by which B2B buyers evaluate a manufacturer in this space. The modern process often begins with advanced measurement techniques that re-create OEM panels with extraordinary fidelity. 3D scanning of original body panels provides a digital reference that helps ensure fitment with near perfection. From there, design teams may propose improvements that blend better mounting fidelity with practical benefits like reduced flex under load or more efficient airflow pathways. Such enhancements are not gimmicks; they reflect a disciplined approach to engineering optimization that aligns with the expectations of riders who ride hard and need parts that won’t crack under stress. Material selection remains a critical variable. ABS plastic remains widely favored for its balance of durability, weight, and cost. Yet the market is not static. Advances in resin formulations, improved pigment systems for UV resistance, and better bonding chemistries have expanded the performance envelope. These developments enable fairings to resist sun fading, endure temperature swings, and maintain crisp graphics even after years of exposure to outdoor elements. In practice, this means a product that preserves its appearance while continuing to protect the engine bay and rider position beneath.

Beyond the panel itself, the practicalities of sourcing shape the buyer’s experience as much as the product. The rise of e-commerce platforms and curated supplier catalogs has given buyers the ability to compare options across the world without committing to long, bespoke negotiation cycles. A foundational strategy for many buyers is to look for suppliers who can demonstrate a track record of consistent quality, robust production capacity, and transparent communication. Documentation and certifications—though not always obvious in the finished piece—serve as important signals of reliability in a market where the product life cycle often includes multiple generations of design. In this context, the value of a strategic sourcing partner becomes clear. A capable supplier can translate a rider’s aesthetic preference into a fully engineered solution that also respects regulatory constraints of the destination market. This is where platforms that connect buyers with verified suppliers can play a crucial role. They provide profiles, certifications, and real-time transaction data that help buyers make informed procurement decisions while maintaining a balanced portfolio of risk.

When it comes to practical procurement, one practical entry point that many buyers consult is a curated catalog that aggregates suppliers with demonstrated capability in high-end aftermarket fairings. The catalog format is less about a single best price and more about a composite view of what a supplier can deliver: design flexibility, material quality, finish options, and the speed with which a project can move from concept to gate. An important part of this approach is compatibility verification. While many OEMs specify high-grade ABS or other polymers, aftermarket providers often offer alternatives that deliver similar performance at a lower cost. The pricing calculus must account for the full lifecycle of the part: installation time, expected wear, and the potential for aftermarket improvements that reinforce mounting points or streamline climate control. It is easy to underestimate how much engineering time lives in what appears to be a simple panel. In reality, several rounds of testing may be required to validate a fitment that looks right on the drawing but must also survive the rigors of real-world riding.

From a buyer’s perspective, the broader market narrative is reinforced by data on growth and competitive dynamics. The global motorcycle fairing market is projected to grow at a compound annual growth rate of about 9.2 percent from 2025 to 2031. This trajectory points to a durable, long-term market for manufacturers who invest in design, process optimization, and supply chain resilience. The drivers include not only engaging aesthetics but also the pursuit of aerodynamic efficiency and cooling performance. Consumers want combinations of form and function that deliver measurable improvements in speed, handling, and engine efficiency, especially in performance and racing contexts. As competition intensifies, manufacturers are pushed to innovate, not simply to undercut price. The result is a market where incremental design improvements—whether in gentle curves that reduce drag or in ducting that channel air more effectively—translate into meaningful consumer value. In this sense, price competition often coexists with performance improvements, and buyers begin to view the purchase as a bundle: a design package that blends look, feel, and measurable performance gains.

For readers who want to explore market context beyond the immediate supply chain, industry analyses place the aftermarket fairing segment within a broader framework of consumer preferences and economic conditions. The market’s expansion is tied to rising disposable income in key regions, the growth of motorcycle touring and sport riding, and a growing willingness to invest in personalization. At the same time, the supply side has learned to manage volatility by diversifying material sources, expanding production footprints, and improving automation. The combined effect is not a simple industrial trend but a sophisticated orchestration of design intent, engineering rigor, and logistical execution. The Guangdong ecosystem exemplifies how this orchestration can unfold in practice: a hub where design studios, tooling shops, coating houses, and final assembly lines operate in a rhythm that makes rapid prototyping practical—and scale feasible. The broader implication for buyers is clarity about what is realistic to expect. Rather than relying on a single supplier, experienced buyers embrace a network approach, selecting partners who can deliver on fit, finish, and function while maintaining consistent communication and predictable delivery.

As this market matures, the expectations surrounding quality control and design iteration become more stringent. Digital tools for measurement and simulation enable more accurate forecasting of performance outcomes before any production runs. The ability to test fitment with near OEM-level fidelity reduces the risk of returns and post-sale adjustments. In practice, this means fewer surprises when a kit lands at a warehouse or on a shop floor. It also means faster translation from concept to customer, because design changes can be validated and implemented with less downtime between iterations. For manufacturers, the economic implication is clear: investing in precision tooling, material science, and process automation pays off in shorter lead times, better yield, and higher customer satisfaction. For buyers, it translates into more consistent quality, clearer expectations around compatibility, and the potential for customization without sacrificing reliability.

Looking ahead, the market’s trajectory will be shaped by how well manufacturers can balance mass customization with scalable operations. The Guangdong model demonstrates that the best outcomes arise when engineering insight and supply chain discipline walk hand in hand. As new materials emerge, coatings become smarter, and digital twins of vehicle bodies proliferate, the opportunity to blend aesthetics with rigorous performance criteria will only grow. This convergence is not about chasing trends; it is about building a dependable, responsive manufacturing fabric that can meet the demand for both speed and sophistication. In this sense, aftermarket fairing manufacturers are becoming not just suppliers of shells, but partners in design, testing, and long-term value creation for riders who demand more from their machines and from the communities that support them. For readers seeking practical avenues to explore these opportunities, a curated catalog can serve as a starting point to assess capability, while a broader market study can illuminate the strategic choices that shape price, quality, and delivery across global markets. As the market expands, so too does the chance to align a rider’s vision with a factory’s precision, turning every fairing into a statement of performance and personality.

For those seeking further context on market dynamics and outlook, the following external resource provides a thorough analysis of size, growth trends, and competition within the aftermarket fairing sector: Motorcycle Fairing Market Report: Trends, Forecast and Competitive.

Internal resource reference: Buyers can explore specific catalogues through a curated collection such as the Honda fairings page to see how suppliers present line-ups, materials, and finish options in a format that supports direct comparison and rapid decision-making. See: Honda fairings for a representative example of how suppliers structure product families, detail finish options, and communicate fitment notes in a way that helps teams plan a project timeline and budget.

Final thoughts

The aftermarket motorcycle fairing sector is a vibrant and essential part of the larger motorcycle industry, providing a wealth of opportunities for business growth and innovation. As the market continues to evolve with technological advancements and shifting consumer preferences, staying informed about sourcing strategies, leading manufacturers, and emerging trends is crucial. By implementing these insights, business owners can enhance their offerings, cater to diverse customer needs, and ultimately drive success in this competitive market.